sales tax in austin texas 2021

Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example. Texas Sales Tax Guide For Businesses.

5 Things To Know About Commercial Property Tax Rates In Austin Texas Protax

Wayfair Inc affect Texas.

. Austin TX Sales Tax Rate. What Is The Austin Texas Sales Tax Rate The Base Rate In Texas Is 6 25. 12302 Abney Drive.

The sales tax rate does not vary based on zip code. Aurora TX Sales Tax Rate. Austonio TX Sales Tax Rate.

A tax rate of 05542 per 100 valuation has been proposed by the governing body of the City of Austin. Avoca TX Sales Tax Rate. Total sales tax revenue for the three months ending in April 2021 was up 45 compared to the same period a year ago.

The no-new-revenue tax rate would Impose the same amount of taxes as last year if you compare properties taxed in both years. There is no applicable county tax. Did South Dakota v.

For specific information about a citys ordinance please contact the city. General Median Sale Price Median Property Tax Sales Foreclosures. General Median Sale Price.

2021 Sales Tax Holiday In Texas Is August 6 8 Klbk Kamc Everythinglubbock Com. Sales Tax In Austin Texas PepWholesale Trade Sales in Austin Hays County TX. 3 rows The current total local sales tax rate in Austin County TX is 6750.

General Median Sale Price Median Property Tax Sales Foreclosures. What is the Texas sales tax rate 2021. The average cumulative sales tax rate in Austin Texas is 825.

The minimum combined 2022 sales tax rate for Austin County Texas is. Subdivision in Austin TX. The average sales tax rate in Arkansas is 8551.

3 rows The current total local sales tax rate in Austin County TX is 6750. Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825. The December 2020.

This includes the rates on the state county city and special levels. The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use tax up to 2 percent for a total maximum combined rate of 825 percent. The no-new-revenue tax rate is the tax rate for the 2021 tax year that will raise the same amount of property tax revenue for the City of.

Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. The Austin County sales tax rate is.

Not just news. The base state sales tax rate in Texas is 625. 625 percent of sales price minus any trade-in allowance.

Top Property Taxes Turtle Rock Ests. ICalculator US Excellent Free Online Calculators for Personal and Business use. 11109 El Capitan Dr Austin TX 78747 is listed for sale for 499999.

11816 Lansdowne Road Austin TX 78754. The Austin sales tax rate is. What We Do - How It Works.

ICalculator US Excellent Free Online Calculators for Personal and Business use. This is the total of state and county sales tax rates. Our weekly newsletter provides insights on Texas politics the economy and Austin local news.

The Texas state sales tax rate is currently. This notice provides information about two tax rates used in adopting the current tax years tax rate. The County sales tax rate is.

Date Published 2021-04-02 051927Z. Top Property Taxes Belhaven. The 825 sales tax rate in Austin consists of 625 Texas state sales tax 1 Austin tax and 1 Special tax.

Ad Find Out Sales Tax Rates For Free. To make matters worse rates in most major cities reach this limit. Avery TX Sales Tax Rate.

Austin collects the maximum legal local sales tax. Licensing Requirements for Sales in Austin. Texas Sales Tax.

2705 Tether Trail Austin Tx 78704 Mls 8821449 In 2021 Ranch Style Ranch Style Home Open Concept Layout. Avalon TX Sales Tax Rate. Information reflective of 2021 Recorder Assessor Data.

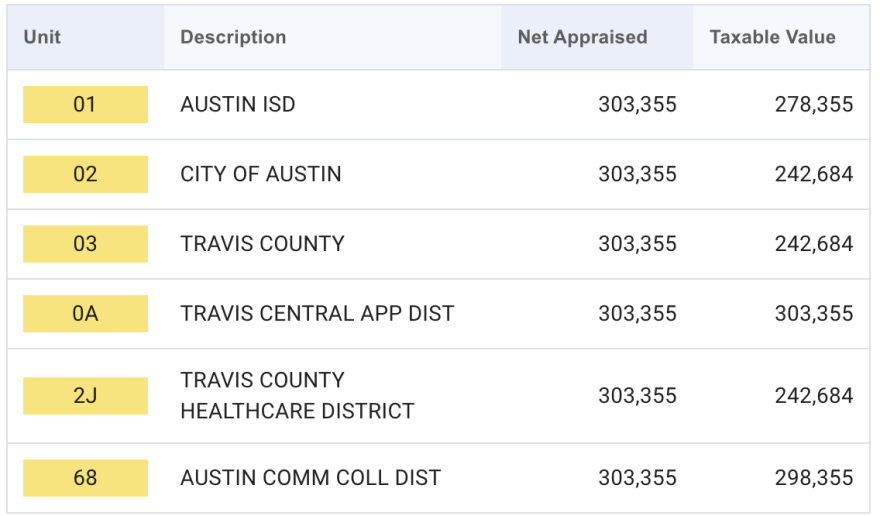

Find your Texas combined state and local tax rate. Axtell TX Sales Tax Rate. 2021 Travis County Appraisal District Tax Value.

The minimum combined 2022 sales tax rate for Austin Texas is. Austin County TX Sales Tax Rate. Subdivision in Austin TX.

Raised from 625 to 825 Alvarado Venus Grandview Godley. You can print a 825 sales tax table here. Information reflective of 2021 Recorder Assessor Data.

The 2018 United States Supreme Court decision in South Dakota v. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. If you have questions about Local Sales and Use Tax annexation and disannexation information or if you want copies of the boundary changes including ordinances and maps please contact us at TaxallocRevAcctcpatexasgov.

Has impacted many state nexus laws and sales tax collection requirements. Sales tax is the largest source of state funding for the state budget accounting for 59 of all tax collections. Austin in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Austin totaling 2.

It is a 011 Acres Lot 2253 SQFT 4 Beds 2 Full Baths 1 Half Baths in. Read the full 2021 Approved Tax Rate Notice here. The Arkansas sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. Method to calculate Austin sales tax in 2021. Austwell TX Sales Tax Rate.

This is the total of state county and city sales tax rates. General Median Sale Price Median Property Tax Sales Foreclosures. Within Austin there are around 72 zip codes with the most populous zip code being 78745.

Austin has parts of it located within Travis County and Williamson County. This notice concerns the 2021 property tax rates for City of Austin. For tax rates in other cities see Texas sales taxes by city and county.

The Texas sales tax rate is currently. Texas sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Avinger TX Sales Tax Rate.

6 rows The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and. Fast Easy Tax Solutions.

Best Suburbs Near Austin Texas Newhomesource

Opinion Who Pays 278 Million Austin Taxpayers Or Private Developers Council Should Not Vote To Divert City Tax Dollars To The South Shore Property Owners Columns The Austin Chronicle

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

What Is The Real Cost Of Living In Austin 2022 Bungalow

Stay At Our Hotel Near Lady Bird Lake Hyatt Regency Austin

The Value Of Your Travis County Home Has Gone Up A Lot That Doesn T Mean Your Property Taxes Will Austin Monitoraustin Monitor

The Pros And Cons Of Living In Austin Tx Home Money

Texas Sales Tax Guide And Calculator 2022 Taxjar

The New Texas Migration Why More People Are Choosing To Live Work And Invest In The Lone Star State San Antonio Business Journal

Texas Taxes Economic Development Incentives Txedc

Apply In Ontario S Best Colleges For Your Higher Education

Northwest Austin Residents To See Unprecedented Spikes In Home Valuations This April Community Impact

12 Incredible Airbnbs In Austin Texas Wandering Wheatleys

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Why Austin Texas Wants To Be An Autos City Yes Austin Best Hotels In Austin Downtown Austin Austin 6th Street

Texas Shoppers Get Ready To Buy Clothing School Supplies More Tax Free In 2022 Teacher Discounts Tax Free Weekend School Supplies

2022 Cost Of Living In Austin Texas Bankrate

/https://static.texastribune.org/media/files/e6a25cb17ab2c3572ed710eb3748ddc0/Housing%20North%20Austin%20AI%20TT%2007.jpg)

Analysis Texas Property Tax Cut Measure Passed With The Long Game In Mind The Texas Tribune

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity